Develop Products and Services Based Technology in 2015, Bank Jatim Ready to Give the Best

Date: 18 february 2015Categories :

The service is an integral part in the banking business. To be able to win the competition in the banking industry increasingly competitive, each bank supposedly able to provide the excellent service with superior products to every customer.

The service is an integral part in the banking business. To be able to win the competition in the banking industry increasingly competitive, each bank supposedly able to provide the excellent service with superior products to every customer.

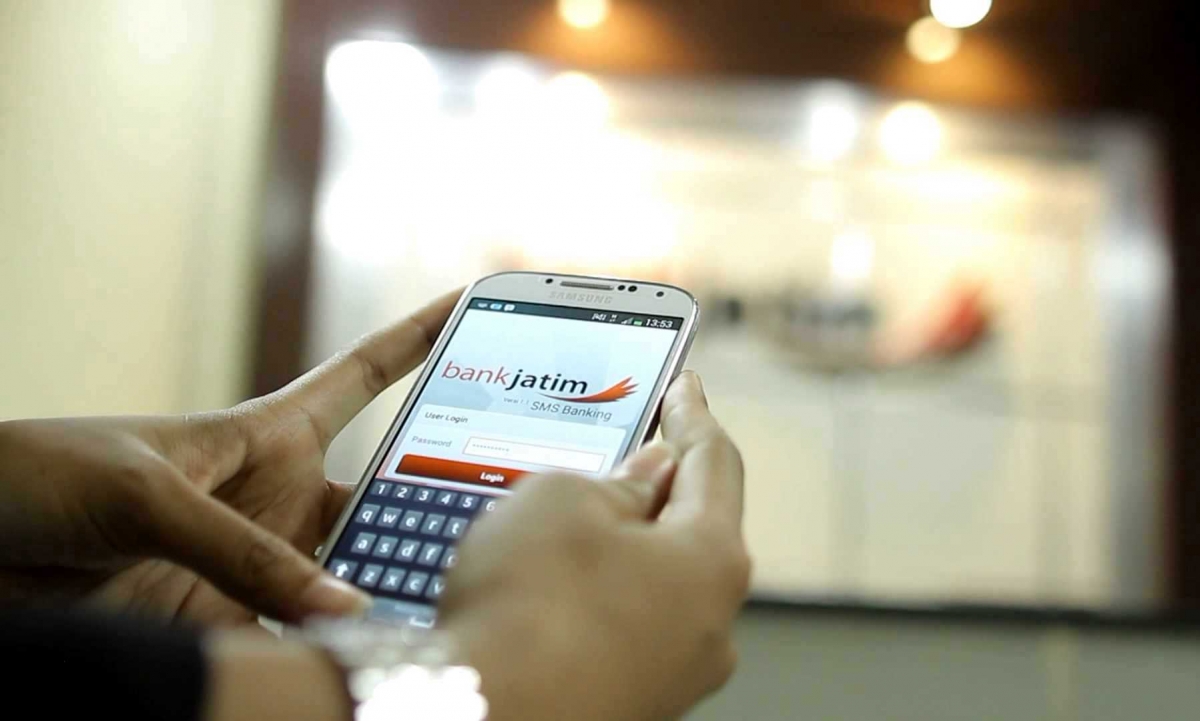

To be able to answer these challenges, bankjatim very concerned with the development of technology-based products and services since 2011.Efforts to continue to develop products and services, continuously improved bankjatim in welcoming the era of digitalization of financial services that the closer and provide service to customers. In 2014, bankjatim has developed various of products and services at more advanced levels, such as SMS Banking bankjatim 3366 with features that are more varied, Flazz bankjatim cards, Savings Siklus with Interest Plus Program and the launch of the dealing room.

Issuance of new products being prepared bankjatim to gradually launched in the first quarter to the fourth quarter in 2015, among others, are mobile banking, priority banking, mutual funds, Electronic Data Capture, bancassurance, virtual accounts, e-money and visa networks. Besides, bankjatim will also further develop the product of individual internet banking, e-tax local payment, host to host, as well as the migration of chip cards.

Issuance the product has been through various considerations for bankjatim progress, among other mobile banking or online banking services using a smartphone. This service is intended as an alternative delivery channel in addition to the teller, ATM and SMS Banking. For the initial stage, which is the main target of all customers both conventional and sharia bankjatim potentially and has high transactional patterns such as employers, government and private agencies, educational institutions and others. The next stage is to increase the number of new customers and provide quality services that will create a sense of safely and comfortably.

Individual customers with a high volume of transactions is the main target of bankjatim in marketing internet banking product.Because bankjatim has become the people's choice in East Java, then bankjatim should further improve the service with one way to provide online banking services through internet banking bankjatim.

As for supporting the need for a system that is able to assist local governments in monitoring the value of the tax that must be paid by the taxpayer as well as a means of online payment of local taxes of all taxpayers, bankjatim initiated to perform system development services Online Local Tax payment (E-Tax ) which is able to accommodate the needs of the local government in all regions of East Java as the one giving the best services from bankjatim. This service helps provide certainty of tax payments to the local government for the people, improving public services to East Java and provide tax calculation results

precisely and accurately to the Local Governments.

While priority banking services to be provided bankjatim to customers is to obtain a more profitable facilities as a form of reward for loyal customers with a portfolio that will be specified further. In this case bankjatim aims to increase loyalty of priority customers by providing top class service. In priority banking, customers will get the products and services of mutual funds, bancassurance and other excellent benefits.

President Director of bankjatim, Hadi Sukrianto convey that to be able to compete with the banking business situation and current market developments then it is supposed bankjatim to innovate in products and services based on high technology.

"Technology is one of the main elements in the future of banking, if we are able to utilize and develop existing products and services with a touch of technology in it is expected bankjatim can better compete in the banking industry. This is one of the strategies for the achievement of third party funds and also intended as an increase in fee-based income. While all development plans and publishing products as well services currently under preparation and will be subject to approval from the Financial Services Authority prior to launch "said Hadi.

Director of Medium Business & Corporate bankjatim, Djoko Lesmono adding that the innovation of products, bankjatim will further facilitate customer service in the transaction, providing more financial solutions for all levels of society and be able to improve the overall performance of bankjatim.

"Innovations products are constantly being developed is one of the triggers raising the growth of third party funds bankjatim in the period December 2014 (unaudited), which recorded a number Rp30,27 trillion, up 16.48% from the same period last year, (YoY). The target of raising bankjatim Third Party funds planned for 2015 is to grow 17.13% "said Djoko.

Hadi asserted that besides continuously improve the services and products are diverse and meet customers' demands, bankjatim also constantly working to improve financial performance in order to continue to grow over time in a sustainable manner. "Improved products and services bankjatim and efforts to continue to maximize best potential in order to always grow in a sustainable manner is a commitment to continue to provide bankjatim Best For You," he concluded. (pr / med)