Investing in Retail SBN (State Securities) via JConnect Invest.

Date: 02 february 2026Categories :

Retail State Bonds (ORI) are Government Bonds sold by the Government to retail investors in the Domestic Primary Market, issued in scripless form, and tradable in the Secondary Market.

Product Specifications

- The specifications for ORI029 are as follows:

-

Description ORI029 – T3 ORI029 – T6 Offering Period January 26, 2026 – February 19, 2026 Settlement Date February 25, 2026 Tenor 3 Years (February 15, 2029) 6 Years (February 15, 2032) Coupon Type Fixed Rate Coupon Rate 5.45% per annum 5.80% per annum First Coupon April 15, 2026

(Coupon payment is made on the 15th of every month. If the 15th falls on a holiday, it will be paid on the next working day)Minimum Order Rp 1,000,000 and Multiples Apply Maximum Order Rp 5,000,000,000 Rp 10,000,000,000 Cashback Rp 50,000 for minimum order of Rp 100,000,000

(Fresh Fund) via J-Connect Invest AppTaxation Final tax 10% of monthly coupon

Advantages

- Advantages of investing in Retail State Bonds (ORI) include:

- Safe, with Coupon and principal guaranteed by the State.

- Attractive Coupon, higher than the average Deposit rate, with lower tax.

- Fixed Coupon, until maturity.

- Affordable Investment, with a minimum investment of only Rp 1 million.

Product Risks

- Default Risk: Default risk is the risk if the investor cannot obtain the payment of funds promised by the issuer when the investment product matures, regarding both coupon and Nominal Value. As a capital market instrument, ORI029 is considered a risk-free instrument because the payment of coupons and Nominal Value of ORI029 is guaranteed by the Government based on the SBSN Law and the State Budget Law.

- Liquidity Risk: Liquidity risk is the potential loss if, prior to the Maturity Date, the owner of Retail State Bond Series ORI029 who requires cash experiences difficulty in selling ORI029 in the Secondary Market at a fair (market) price. Holding period until April 15, 2026. ORI029 can be traded starting April 16, 2026.

- Market Risk: Market risk is the potential loss (capital loss) if there is an increase in interest rates which causes a decrease in the secondary price of ORI029 in the Secondary Market before the Maturity Date to a selling price lower than its purchase price.

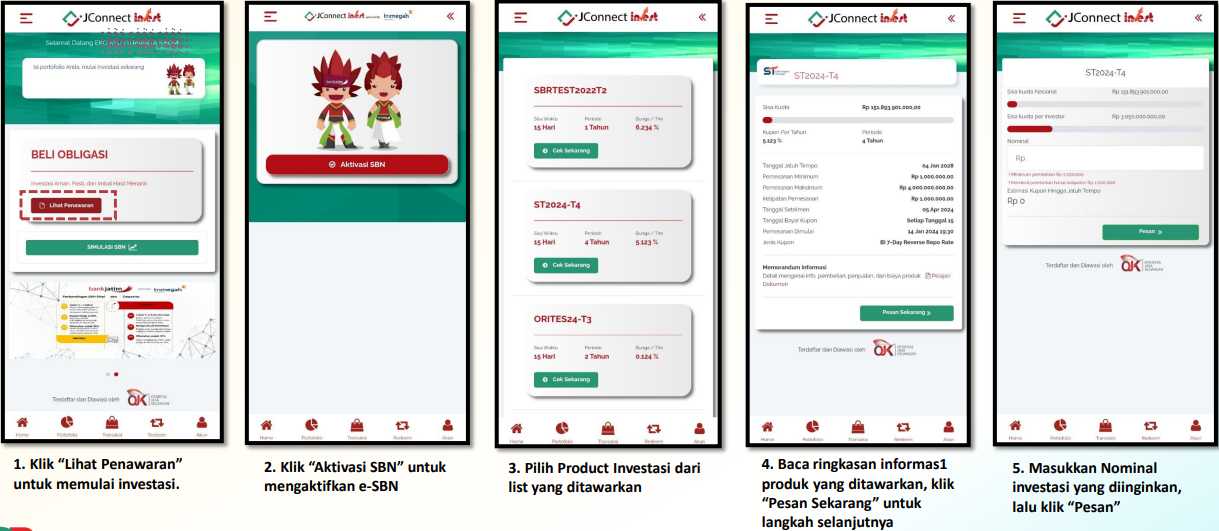

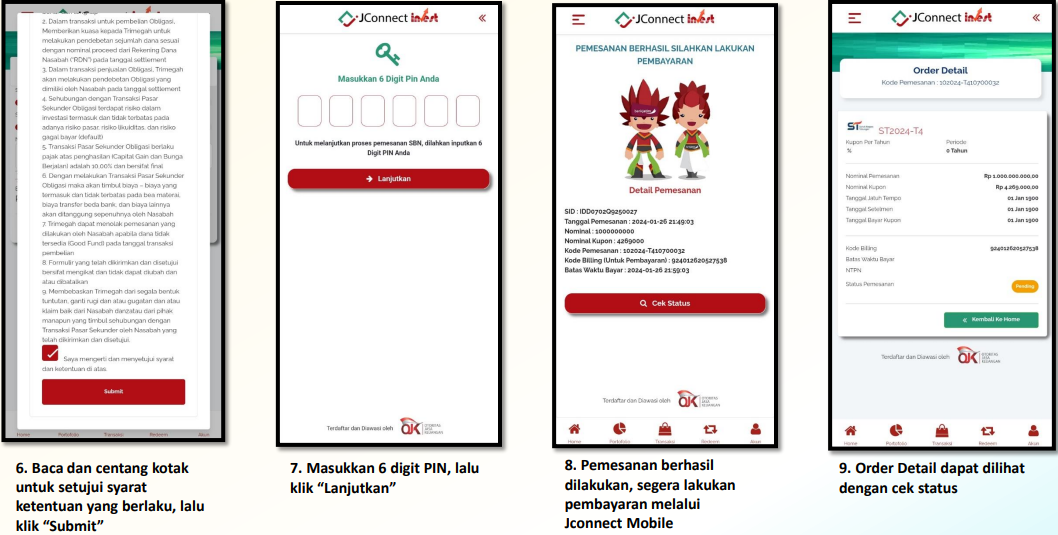

Ordering Procedures

Coupon Simulation

Fees and Obligations

- Fees and obligations that may arise on ORI029 are as follows:

- Securities Custody Fee (Custody Fee) by Custodian of 0.0111% per annum of ORI029 Ownership Nominal.

- Free Coupon Transfer Fee.

- 10% Tax on Coupon.

Purchase Requirements for Retail State Bond Series ORI029

- Individual, Indonesian Citizen proven by KTP registered at Dukcapil.

- Have a Fund Account at Bank Jatim.

- Have a Securities Account and Single Investor Identification (SID) registered at Bank Jatim.

- Activate/Update J-Connect Invest by BankJatim.

Disclaimer

- This brochure serves as information regarding Retail State Securities (SBN Ritel) and is not intended as an official offer to buy.

- Please carefully study all information regarding the Retail SBN offer before you invest. BankJatim is not responsible for losses experienced by investors who invest in Retail SBN. Customers are required to read and understand the Retail SBN Information Memorandum before investing in ORI029.

- The decision to purchase Retail SBN should be adjusted to investment needs and investment risk preference levels.

- Retail SBN is not a Banking product; Bank Jatim solely acts as a Distribution Partner appointed by the Ministry of Finance.

For further provisions/information regarding our products, please contact Info Bank Jatim 14044 or come directly to a Bank Jatim Branch Office