Bank Jatim Raise Net Profit of Rp. 1.49 Trillion Throughout 2020

Date: 14 april 2021Categories :

SEMARANG – 14 April 2021. In order to provide information disclosure, PT Bank Pembangunan Daerah Jawa Timur Tbk or bankjatim held an analyst meeting to explain the financial performance of the 2020 Financial Year (audited) through a zoom meeting located in Semarang (14/04).

2020 was a tough year for the banking industry, the Covid-19 pandemic that hit almost all parts of the world made the business sector experience a decline and had an indirect impact on the performance of the banking industry. However, bankjatim is grateful, in the midst of a pandemic, bankjatim is still able to record positive performance growth when compared to the previous year (Year on Year / YoY).

bankjatim's financial performance for the 2020 Financial Year shows good performance and grows when compared to the same period in the previous year (Year on Year / YoY). When compared with the performance of the banking industry nationally and regionally East Java, bankjatimperformance growth is above the average growth.

Based on the performance in December 2020, bankjatim assets were recorded at Rp. 83.62 trillion or growing 9.00%, bankjatim net profit was recorded at Rp. 1.49 trillion or grew 8.17% (YoY). During the 2020 Financial Year, bankjatim Third Party Funds (DPK) recorded a growth of 13.08% (YoY), namely Rp. 68.47 trillion. The significant growth in third party funds shows that public trust in bankjatim has increased.

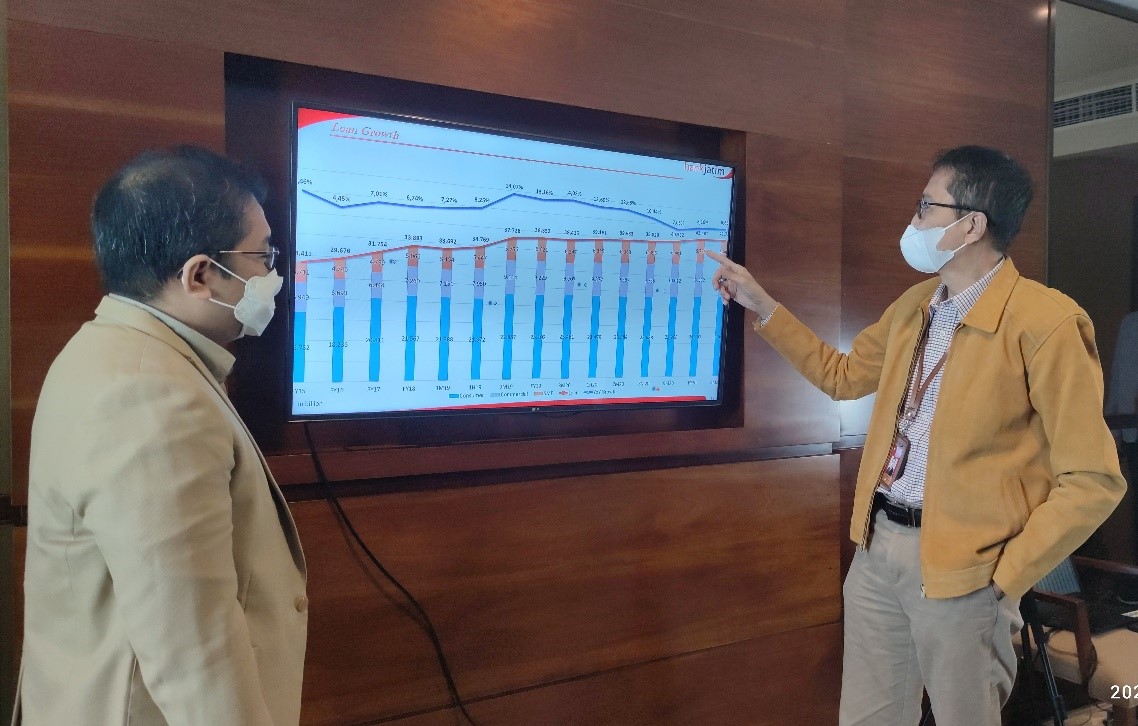

In terms of financing, this time bankjatim was able to record positive credit growth even though in the midst of a pandemic, which grew 8.16% (YoY) or equal to Rp. 41.48 trillion. Credit in the consumption sector was the highest contributor, amounting to Rp. 24.35 trillion or grew by 5.42% (YoY). Followed by a commercial credit of Rp. 10.33 trillion or growing 11.95 and credit in the MSME sector amounting to 6.80 trillion. The composition of bankjatimfinancial ratios for the period December 2020 includes Return on Equity (ROE) of 18.77%, Net Interest Margin (NIM) of 5.55%, and Return On Assets (ROA) of 1.95%.

During the pandemic, bankjatim also participated in supporting the credit restructuring program launched by the Government. As of March 2021, bankjatim has conducted credit restructuring of 3,297 debtors with a total outstanding of Rp. 1.82 trillion or about 4.37% of the total bankjatim credit distribution.

On this occasion, bankjatim also explained the financial performance of March 2021 which also showed positive growth from the previous year (Year on Year / YoY). Total assets were recorded at 89.65 or grew 28.58% (YoY), while net profit was recorded at 448 billion or grew 2.20% (YoY). During the first quarter of 2021, bankjatim credit disbursement was recorded at Rp. 41.73 Trillion or grew by 8.63% (YoY), while third party funds were recorded at Rp. 76.09 Trillion or grew significantly 31.72%.

From this performance, bankjatim is optimistic that it can achieve the target of good financial performance in 2021. Several steps have been prepared to support the achievement of these targets, one of which is the distribution of People's Business Credit (KUR) which will start again this year with a ceiling of Rp. 1 trillion. Furthermore, bankjatim will also try to increase the market share for multipurpose loans, which is currently still at + 60%.

PT BANK PEMBANGUNAN DAERAH JAWA TIMUR Tbk

Jl. Basuki Rahmat 98-104 Surabaya

CORPORATE SECRETARY

E : corsec@bankjatim.co.id / humas@bankjatim.co.id

T : (031) 5310090-99 ext 471 F : (031) 5310838