Increase Synergy Between BPDs, Bank Jatim Organizes Treasury Talk 2023

Date: 09 november 2023Categories :

SURABAYA, NOVEMBER 9, 2023. In order to improve synergy between Regional Development Banks (BPD) throughout Indonesia, PT Bank Pembangunan Daerah Jawa Timur Tbk (bankjatim) has officially held a Treasury Talk forum with the tagline Synergy Drives Business Forward. Located in the Ballroom of The Westin Surabaya, the activity was attended by representatives of Asbanda, BPDs throughout Indonesia, Bloomberg, as well as some of bankjatim's priority customers on Thursday (9/11).

Director of Finance, Treasury and Global Services bankjatim Edi Masrianto explained, Treasury Talk is an interactive discussion and meeting of various parties aimed at deepening understanding of the company's financial management strategy, addressing financial risks, and optimizing treasury performance. "Considering the great sensitivity of treasury in changing global economic conditions, government financial policies, and several other important issues, collaboration from various parties is needed. Therefore, we took the initiative to organize this Treasury Talk forum," he explained.

In addition to Edi Masrianto who explained BPD Jatim on Transaction: Treasury and Trade Finance 2023, the event was also attended by expert speakers in their fields. Among others, R. Achmad Rayadi from the Department of Monetary Management (DPM) and Dopul Rudy Tamba from the Department of Financial Market Development (DPPK) Bank Indonesia as the banking regulator in the country who shared information about the Recent Development of Repo Market and Secondary Market SRBI. Furthermore, there was also Managing Director, Head of Markets and Securities Services HSBC Ali Setiawan who discussed the Global and Indonesia Economic Prospect for 2023 and Beyond, and Asia FICC Senior Associate Strategist - Bloomberg Jason Lee who gave a presentation on Asia Dollar Bond Market, Fed Conundrum and Consequences.

Edi explained, through collaboration between experts and practitioners and regulators, it is hoped that Treasury Talk can become a space to increase synergy between BPDs. In addition, it can also provide innovative and applicable solutions for companies to face complex challenges in the era of globalization like now. "Thus, it is hoped that this event can make a positive contribution in advancing the company's financial management and encouraging sustainable business growth," he said.

According to Edi, in the current era of globalization, corporate and banking finance is one of the critical aspects that can affect performance and business continuity. "Effective and efficient financial management is a must for companies to keep growing in the midst of increasingly fierce competition. In the banking and corporate structure, it is the treasury department that has a vital role in managing assets, debts, and financial risks. Therefore, we organized this event," he said.

In the Treasury Talk, bankjatim also gave an award to Counterparty from BPD as a form of synergy between banks. The awards given are Most Active Treasury Transaction to PT Bank Pembangunan Daerah Jawa Barat dan Banten (BJB) and Most Active GMRA Transaction to PT Bank Pembangunan Daerah Jawa Tengah (Bank Jateng).

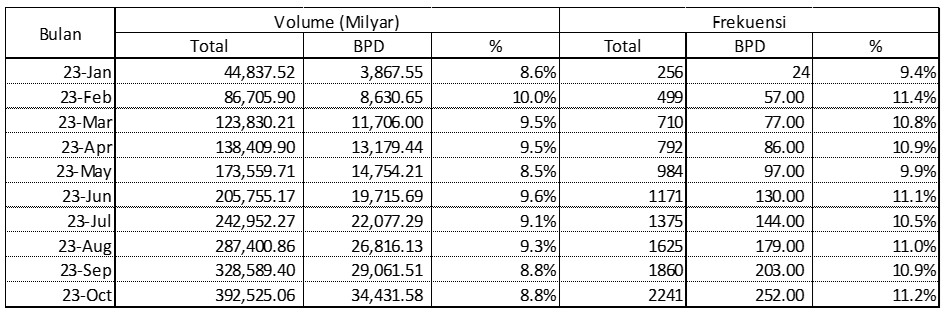

Meanwhile, based on the Blue Print Money Market (BPPU) Bank Indonesia 2025 on the implementation of the money market, bankjatim has prepared itself to be one of the Primary Dealer to support the implementation of monetary operations transactions. The trick is to increase GMRA Transactions on the Interbank Money Market (PUAB). From various banks in Indonesia, especially between BPDs throughout Indonesia, the recorded growth of Bank Jatim GMRA Transactions during 2023 is as follows:

"In the development of trade finance transactions, bankjatim also provides assistance and coaching support to MSMEs that are ready to export in the form of information services on standard export procedures, product curation, as well as conducting business matching, strategy development up to export plans, business practices and negotiations," said Edi.

Not only that, bankjatim also serves businesses in terms of issuing or receiving Letters of Credit on an international scale and Domestic Documented Letters of Credit on a domestic scale. The goal is to mitigate the risk in terms of billing or payment to clients who are constrained by distance and geographical differences as well as differences in character that can cause conditions between the two parties.

In essence, continued Edi, in the development of BPD Transformation in the trade finance transaction business, bankjatim collaboration with other BPDs is very important. Because, it will affect the improvement of the economy between regions in the development of export-import transactions that automatically have an impact on foreign exchange growth. "Hopefully this Treasury Talk event can be an introduction to expand the synergy and cooperation of bankjatim with various parties in order to realize good business cooperation in a sustainable manner," he said.